Evaluating the Long-Term Memory Approach to Modeling Stock Data

The S&P 500 index is one of the most commonly used measures of the performance of the US equities market. It is a capitalization-weighted index which measures the stock performance of the top 500 enterprises in the United States. Successful predictive models of this and other market indexes have clear, obvious real world benefits, showing investors where and when to invest their money. In this report, we document our attempts to predict the S&P 500 using data from other financial indicators (provided by Vulcan Value Partners) and features we extract from these datasets.

Upon interpolation and dimensionality reduction, we adopt various recurrent neural network (RNN)-based models for fitting and generating adequate forecasts across the following time frames: 1 week, 1 month, and 1 year. We find that these models perform well on the training bull stocks within the S & P 500 timeframe (i.e., when the S & P 500 values were visible), but struggle when the economy begins to recede. As such, we would need S & P 500 data from further back in order to account for the 2008 crash. This would enable our deep learning-based forecasting models to project future events such as the COVID-19 pandemic.

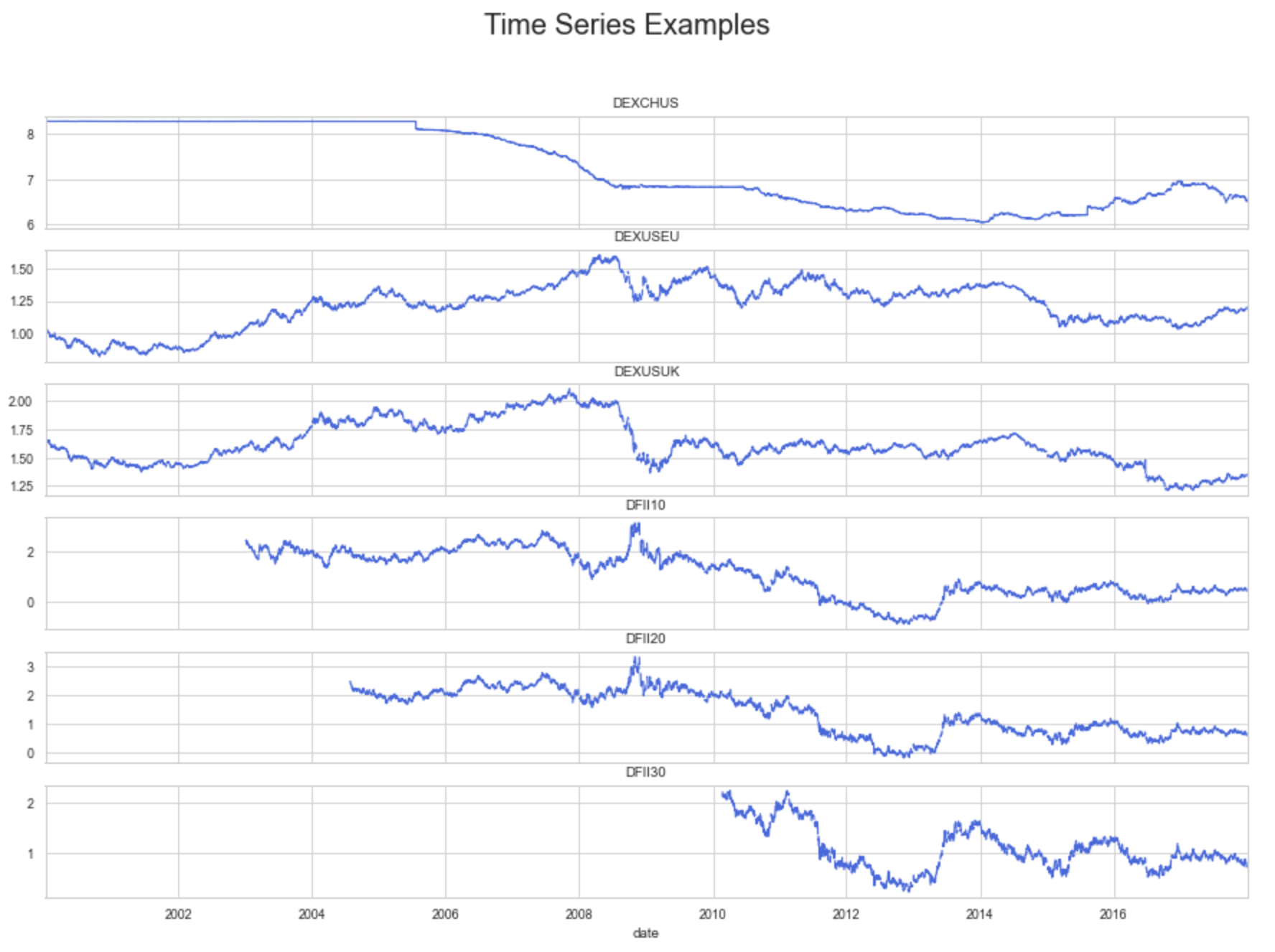

The data comprises 67 financial indicators of the health of the United States economy spanning from the year 2000 to 2020. The indicators measure everything from infectious disease risk to foreign exchange state and unemployment rate. We categorize the 67 features into primarily three categories:

- External Macro Relationships: This group of time series data all share similar characteristics as they are updated every business day. They require minimal data preprocessing techniques. This group includes: multiple commodity futures, major foreign exchange pairs, different treasury related data in order to include the daily macro effects around the world.

- Internal Interactive Effects: This group of data represents the internal interactive effects within the U.S. equity market. This includes indices to measure the “mood” of the market participants. ETFs/market trackers that represent different industries are included with a goal to include the effect of different business cycles.

- Low-Frequency Fundamental Data: The previous two groups allow the models to have an idea of what is happening on a daily basis due to the high frequency of the data. However, in order to measure the financial market, it is also important to look at the lower frequency economic and fundamental data. This group includes lower frequency data that are released on a monthly/quarterly basis, hence data preprocessing techniques such as forward fill or interpolation will be needed. The economic indices are chosen in order to cover the different areas such as growth, inflation, employment, income and expenditure, and debt.

Data Cleaning / Preprocessing

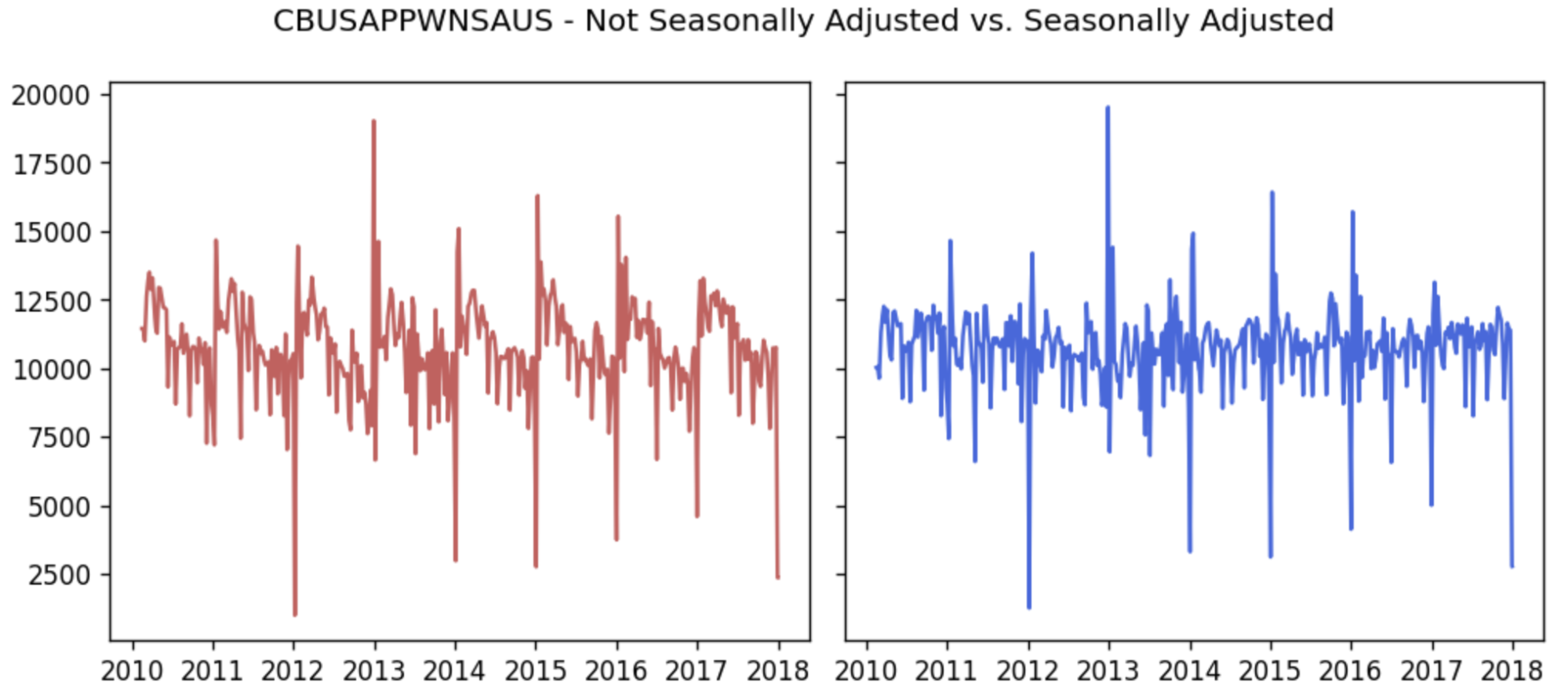

As we are extracting our data from a raw real-time dataset, the dataset contains both valid, informative data and some invalid information such as missing values due to the various measure rates and holidays. To obtain a readable, clear, and understandable dataset, we will be performing data cleaning to assure the accuracy for our data modeling.

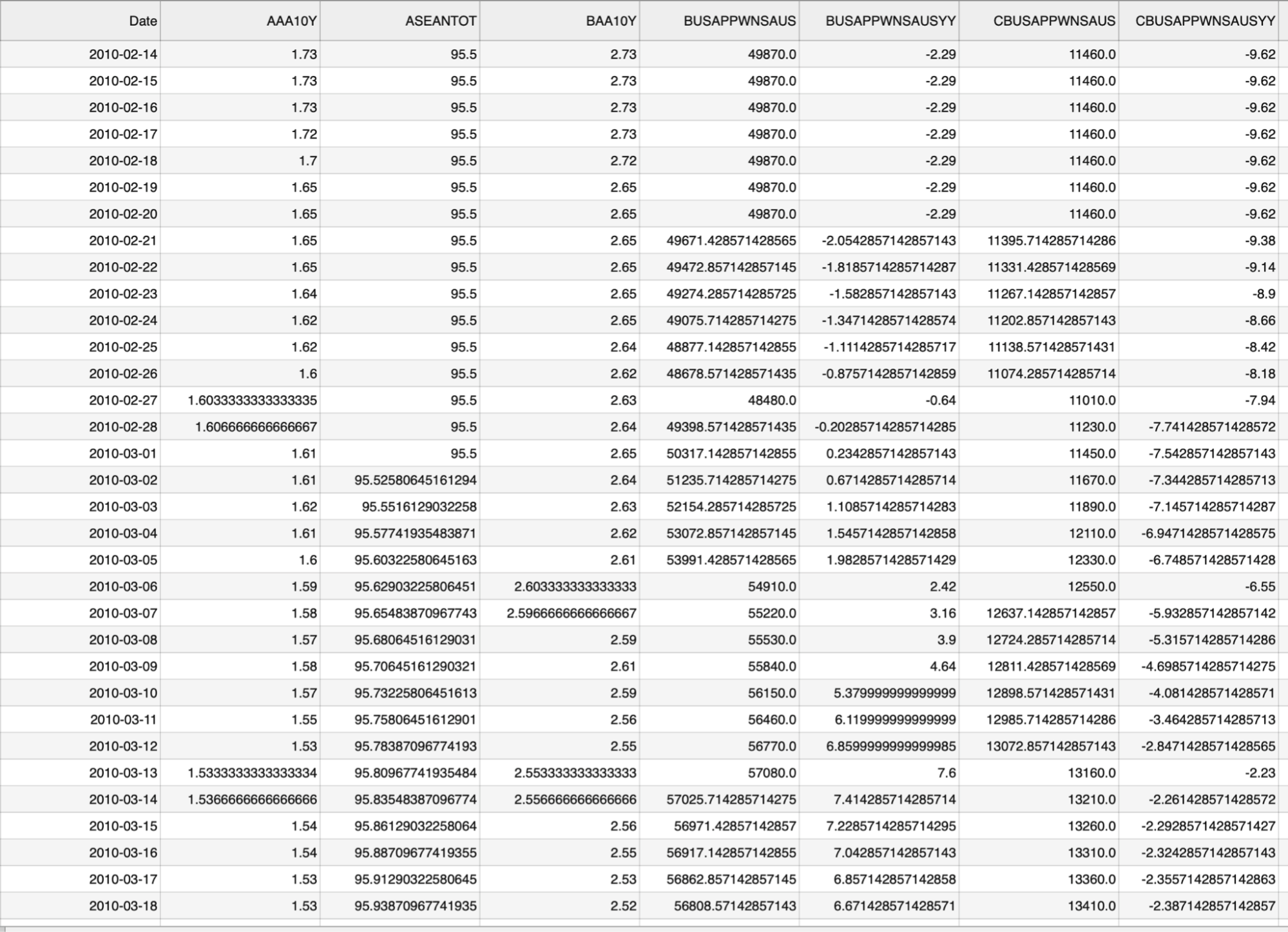

For imputing missing data, we explored multiple different data imputation strategies including but not limited to:

- Interpolate using length of interval (time)

- Forward/Backward Fill

- Rolling Statistics (Mean/Median)

To pick a strategy, we computed the R-squared values on our validation set with all the following methods to find the strategy that produced the strongest linear correlation with the target variable. Interpolating with time provided us with the best results.

First, we assume that our data’s decomposition models follow the “additive” framework, specifically:

We adopt a polynomial fitting method to remove seasonality from a subset of features (see Visualization section), which was preferred to differencing as we retain all data points of that feature. Our model for polynomial fitting is of order 4 and is analytically written as:

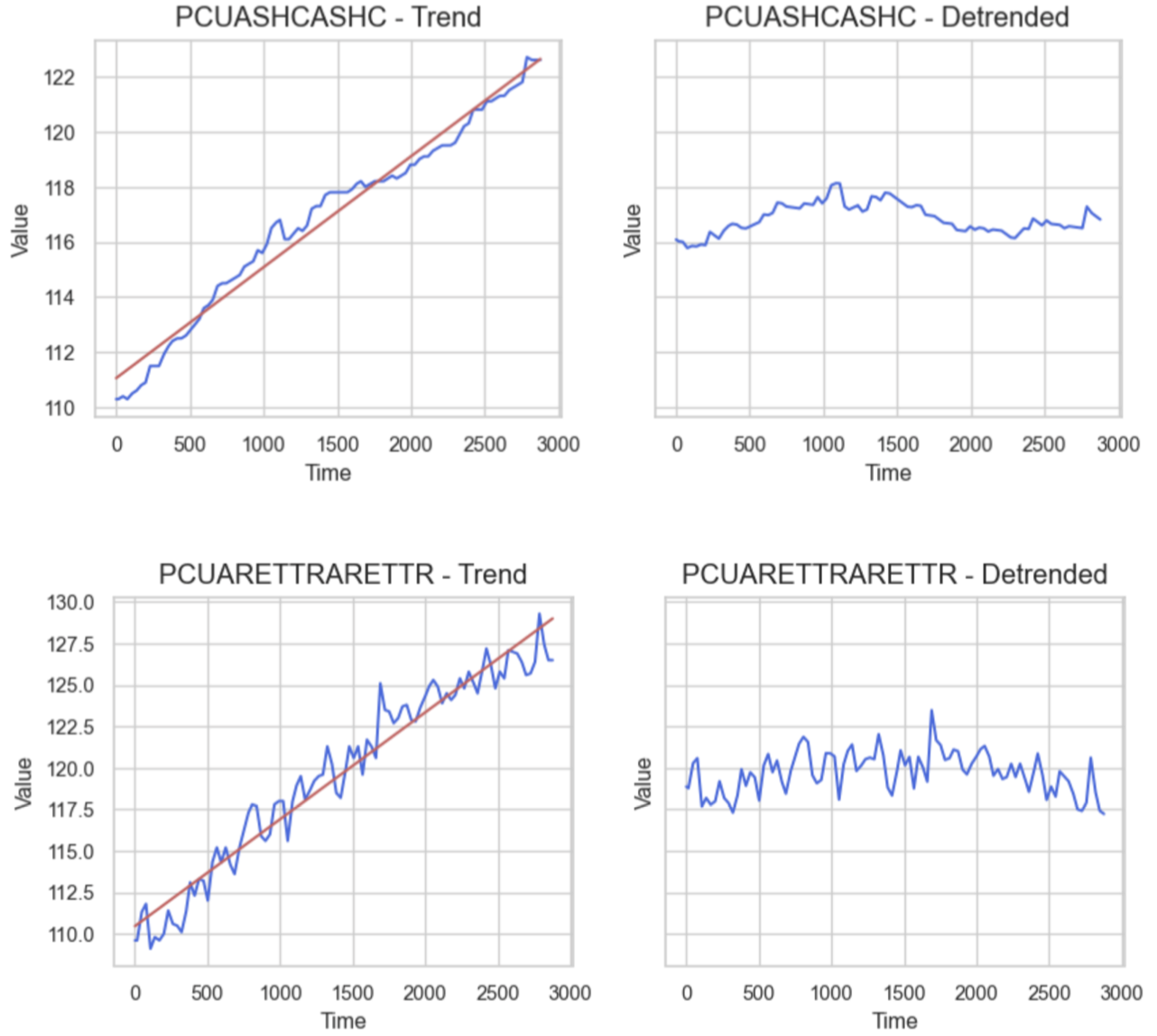

x is our time index, which is the day of the year (each of features are interpolated to fit a daily format), and bi are our learnable coefficients. Shown here are examples of results on a couple of the seasonal features before and after removing seasonality.

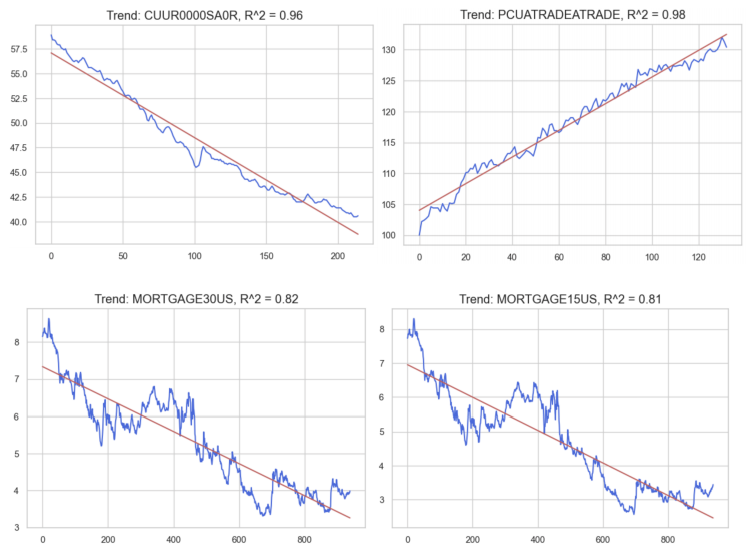

We perform linear regression on a subset of our data such that R2 ≥ 0.75. In order to remove the trend of each each signal, we subtract the the regression values at time t actual values at time t, and then add back the mean of the original signal. Examples of the transformation are depicted here.

Feature Engineering

We augment our data with more information by performing various feature engineering procedures. For all 67 of our features, we compute rolling statistics including the median, mean, and standard deviation, skew, kurtosis, relative minima and maxima, exponential weighted moving average, relative level mean, among others (total of 13 technical analysis indicators). This is done for different rolling window sizes according to the following lookback periods: one week, one month, one quarter, one half of a year, and one year. Next, we cover how we narrowed down our features, for which we employ a five-step process:

- Removing columns with more than 1% of missing data

- Univariate feature selection

- Correlation filter

- REFCV for various estimators

- PCA

We removed the columns where more than 1% of values were missing. This got rid of about 13% of our 4500 columns.

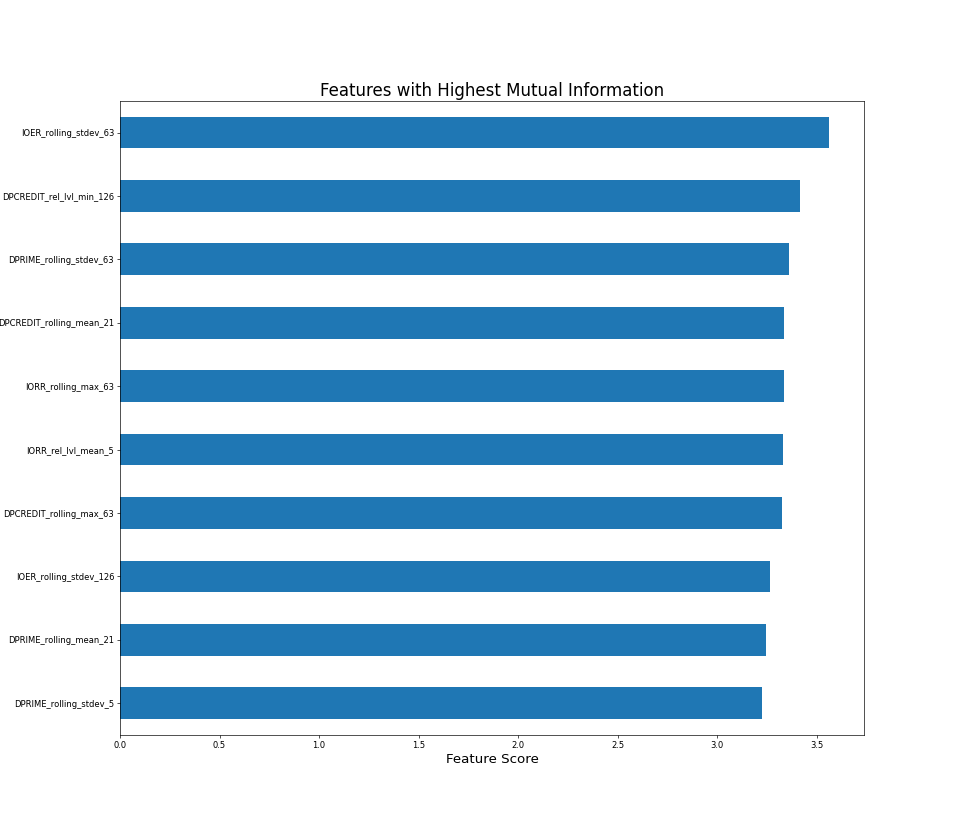

We computed the Mutual Information scores for all the feature engineered columns and dropped the bottom 40% of columns by mutual information.

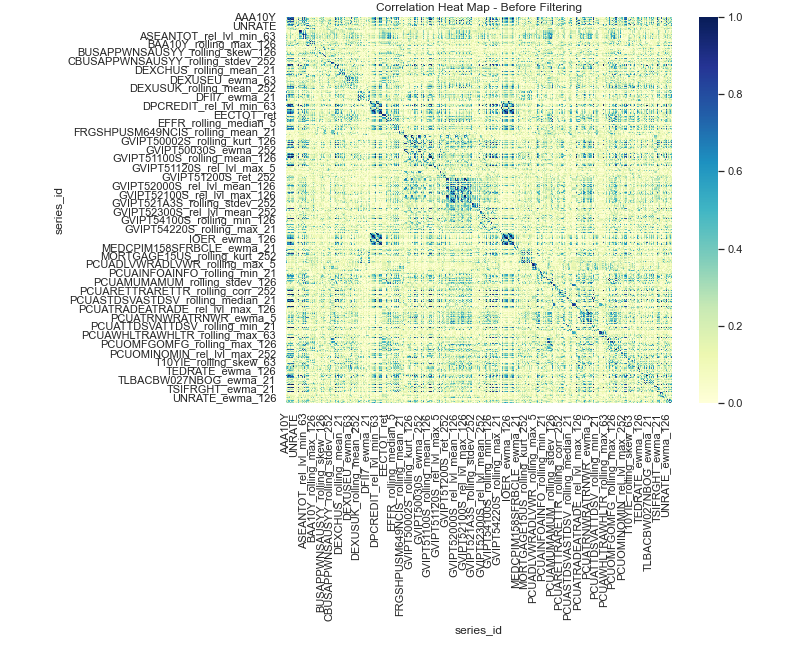

We computed the Spearman Correlation with the remaining columns and drop columns that have a correlation coefficient higher than 0.95. A correlation heatmap generated before this operation is shown here.

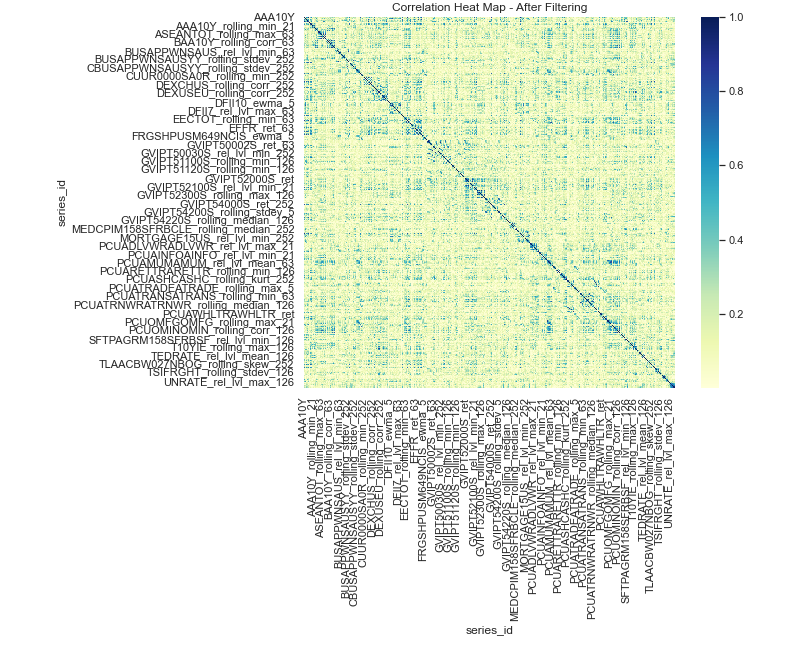

After dropping columns, you can see how there are fewer darker patches at the center indicating a loss of correlated columns. We dropped around 37% (827) of the remaining columns with this step.

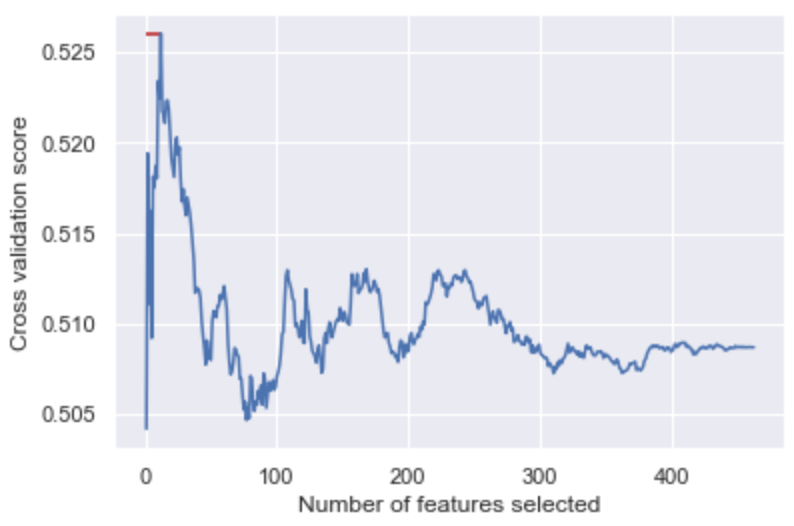

After using two filtering methods (mutual information and correlation), the next step is to use a wrapper method RFECV for each individual classifier. The RFECV function uses recursive feature elimination for a user-defined base estimator to rank the features and use cross-validation to select the best number of features.

Shown here is a graph for the results on a Ridge Classifier. Best validation accuracy is achieved at 12 features for this classifier. This process is repeated to find selectively eliminate features for each classifier.

After getting the best subset of features with RFECV, PCA will be applied to further reduce the dimension of our selected features. To preserve the most amount of information, we keep the number of components that can explain at least 99% of the total variance. Without RFECV, we found that the top 208 components explained over 99% of the variance. With RFECV, this number would vary based on what classifier we performed RFECV on. Usually we’d find a value close to 10 features with RFECV.

We explored other techniques like T-SNE here, but didn’t see any significant differences in model performance suggesting that PCA does a good enough job of learning model representations.

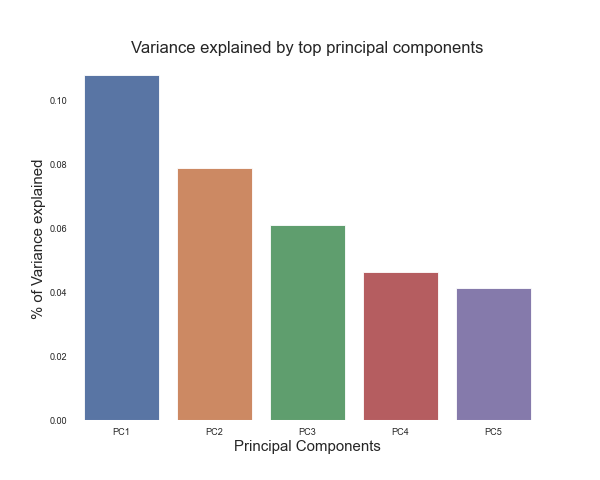

Next, we plot the top 5 principal components with respect to how much variance in S&P 500 value they explain. It appears that the top 5 components explain almost 20% of the variance.

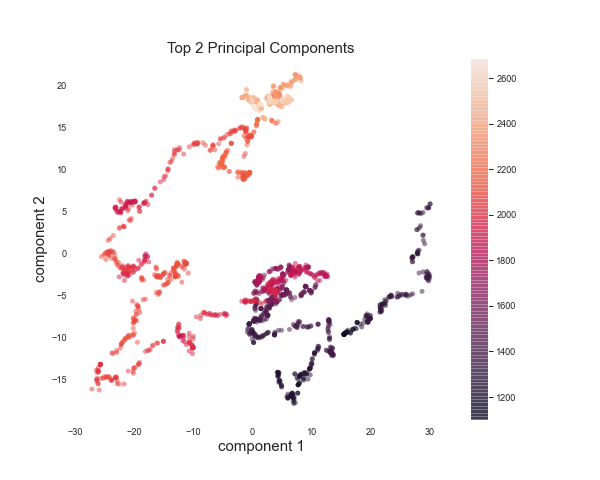

The top two components after running PCA are visualized here. The color bar is the value of the principal component. We can observe a well-defined segregation between the S & P 500 values with the lighter values and darker values clustered together. A “red day” in the stock market appears to be indicated by high values of the features captured by Component 1, and a “green day” appears to be indicated by low-middle values of Component 1 and Component 2.

Each variable in the dataset is represented as a time series, meaning the data points are indexed in time order. The sequences in our dataset aren’t necessarily taken at successive equally spaced points. As evidenced in the example shown here, the data points for each variable are taken at different times and at different frequencies, producing many gaps to be filled.

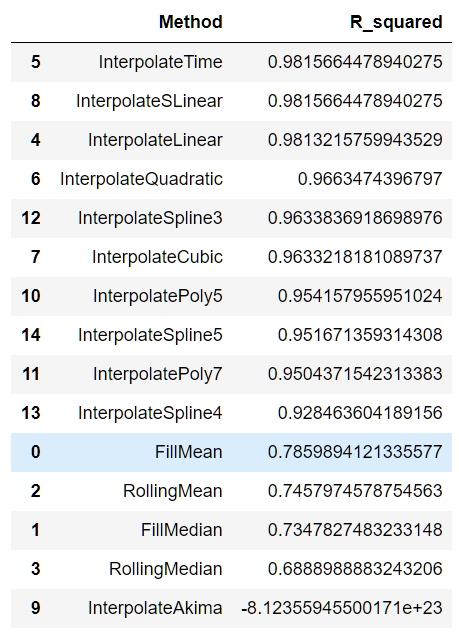

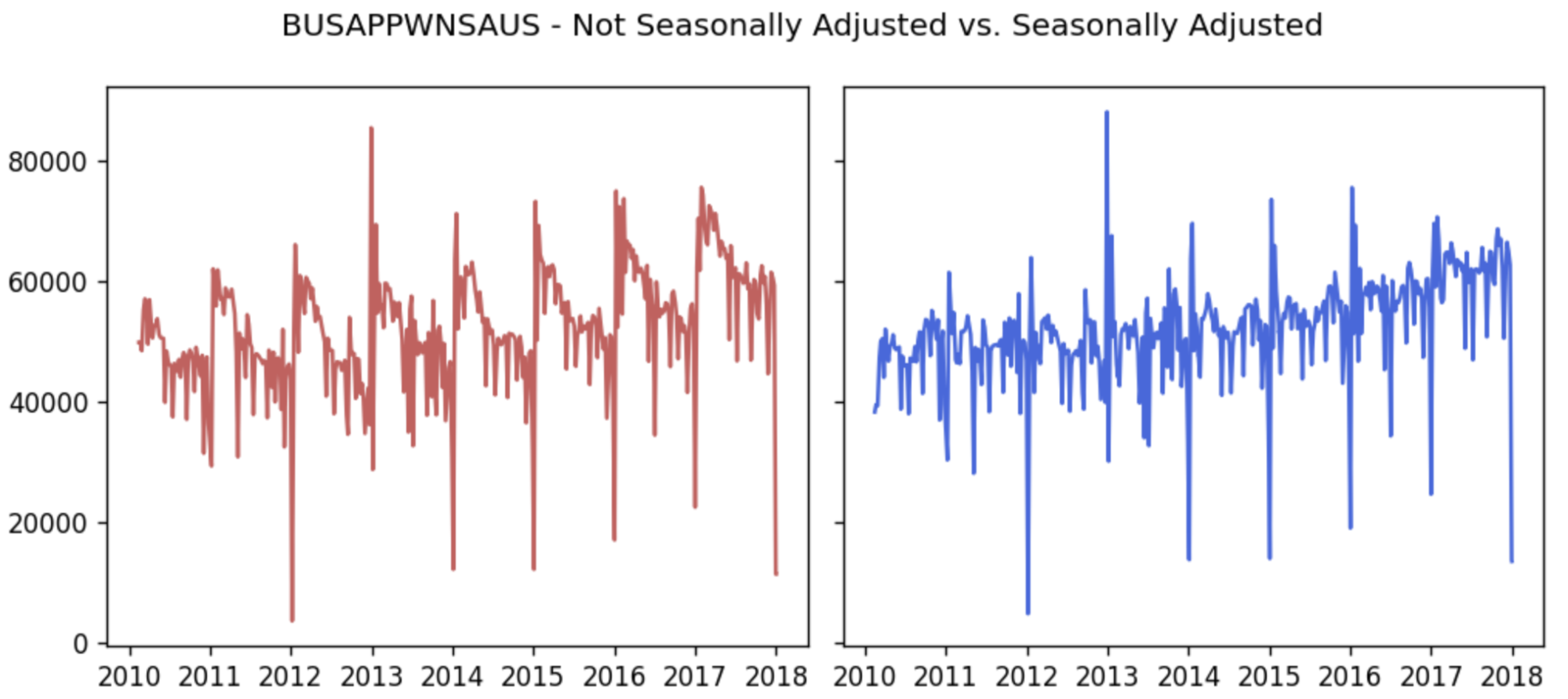

The first factor to account for when modeling time series data is seasonality, one of the main features of a time series decomposition. Seasonality occurs when there are patterns occurring multiple times a year. It is influenced by phenomena including weather or holidays. Seasonal adjustment removes these influences of these phenomena. The majority of the features in this dataset are not seasonally adjusted. We run tests for seasonality on the non-adjusted features and remove these variations accordingly.

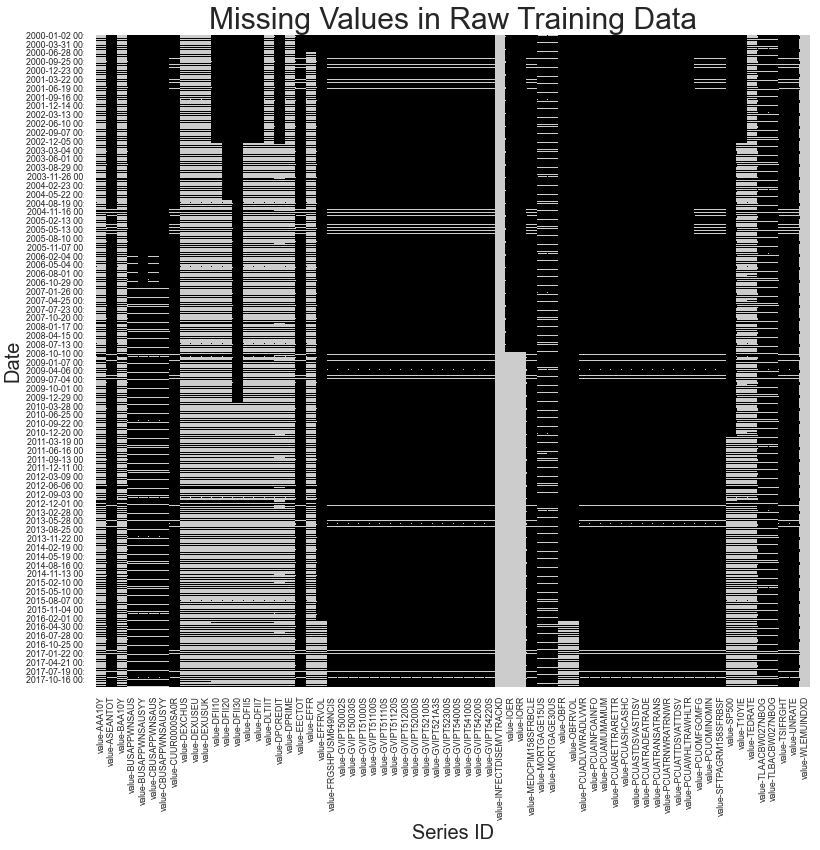

As this dataset contains many different measures collected at different times and rates, a majority of the values will be missing. In the displayed heatmap, each of the black pixels indicates a missing value. Some observations are that the only measures that are collected constantly throughout the date range of this dataset are the Equity Market Volatility: Infectious Disease Tracker and Equity Market-Related Economic Uncertainty indices. As both of these measure economic uncertainty, we hypothesize that these will serve as important features for our forecasting models.

Also, the data for the S & P 500 index, the target variable, don’t appear in this dataset until early 2011. 3.33% of the missingness in the training dataset is found in the S & P 500 index. For this reason, we omit all data that are collected before early 2010, one year before S & P 500 visibility, as we still need some information leading up to that point, as discussed in the previous section.

Another observation is that as indicated by the clusters of non-missing data for measures that are collected monthly, such as the unemployment rate, and the Gross Value of Industrial Products (GVIP) indicators, is that they are collected on a somewhat consistent basis within a few months that occur every two years. The unemployment rates in this dataset are collected with a Household Survey which may be administered at these points in time. The reasons for the GVIP missingness are unknown.

Additionally, the inconsistencies in the missingness patterns in the monthly data in particular suggest that the data are collected at different days within each month. This is likely due to seasonal patterns, which we visualize later in this section. We hypothesize that this will have a minimal impact on our forecasting models.

Seasonality occurs when there is a discernible cyclical pattern dependent on the date within our time series.

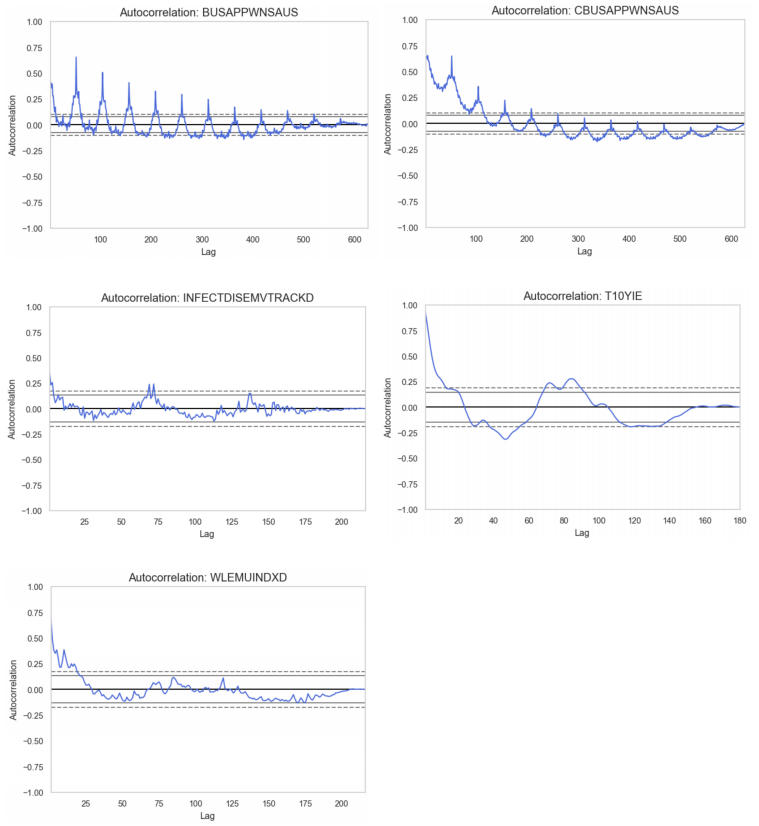

We run inspection tests for seasonality by first taking the subset of the dataset that contains non-seasonally adjusted features. We resample all daily features into monthly means for clarity, and retain the values of the weekly and monthly features. Of all series, we discover that the following five have some seasonal components:

- BUSAPPWNSAUS (Business Applications) - subset of all EIN (Employer Identification Number) applications

- CBUSAPPWNSAUS (Business Applications from Corporations) - subset of High-Propensity Business Applications (HBA)

- INFECTDISEMVTRACKD (Equity Market Volatility: Infectious Disease Tracker)

- T10YIE - ten-year breakeven inflation rate

- WLEMUINDXD (Equity Market-Related Economic Uncertainty Index)

The autocorrelation plots show the correlation of series with itself, when it is separated by varying time lags. We can observe the seasonality in each of the displayed autocorrelation plots as there are apparent cyclical patterns and spikes at lags equal to the period. We proceeded by removing seasonality by means of a polynomial fit, as mentioned in the Preprocessing section.

It is necessary to understand and remove the seasonal components of our time series as they lead to clearer signals, and therefore clearer relationships between our inputs and the output.

Trend is another part of a classical time series decomposition. It refers to a continuous increase or decrease over time. We test for the presence of trends in our data with a linear regression model, and we observe trend if the resulting R2 value is greater than or equal to 0.75. We find a handful of features that exhibit trends, examples of which are displayed to the side. The blue trends are the trends we extracted from the seasonal decomposition of our original signals.

We use these results combined with differencing to detrend our signals (see Data Cleaning and Preprocessing), a process we hypothesize will improve the performance of our subsequent forecasting models.

Analysis and Modeling

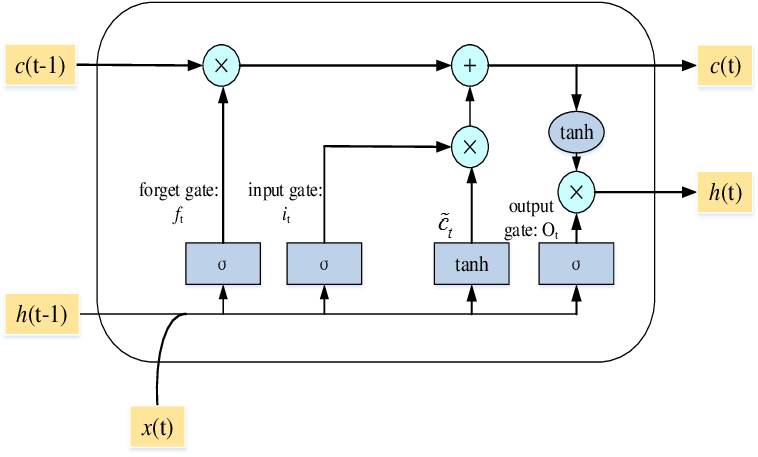

Given the abundance of rich data after cleaning and preprocessing and the complex non-linear ways in which the equities markets react to the economy, we felt that deep-learning based approaches should in-theory provide us the best results. Given the sequential nature of our input data, LSTM-based models were the natural choice. We explored three different sub-classes of models:

This is a run of the mill LSTM model with 50 units and trained with a learning rate set to 10-3. The unique architecture of the LSTM cell pictured here ensures that gradients don’t die down during backprop through time making it a significant upgrade especially for the 1 year timeframe where the backprop goes through many layers leading to gradients dying down and nonoptimal convergence in conventional RNN.

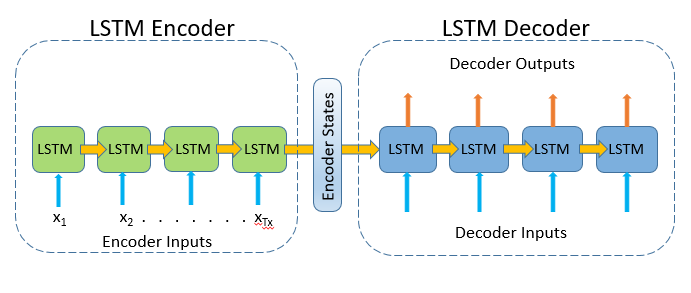

We chose this architecture because it uses a very different modeling approach to the underlying data generating process. This architecture bears a strong resemblance to an autoencoder and similar to an autoencoder it tries to learn good internal representations of the data generating process. Both our encoder and decoder used 200 units and were trained with a learning rate of 10-4.

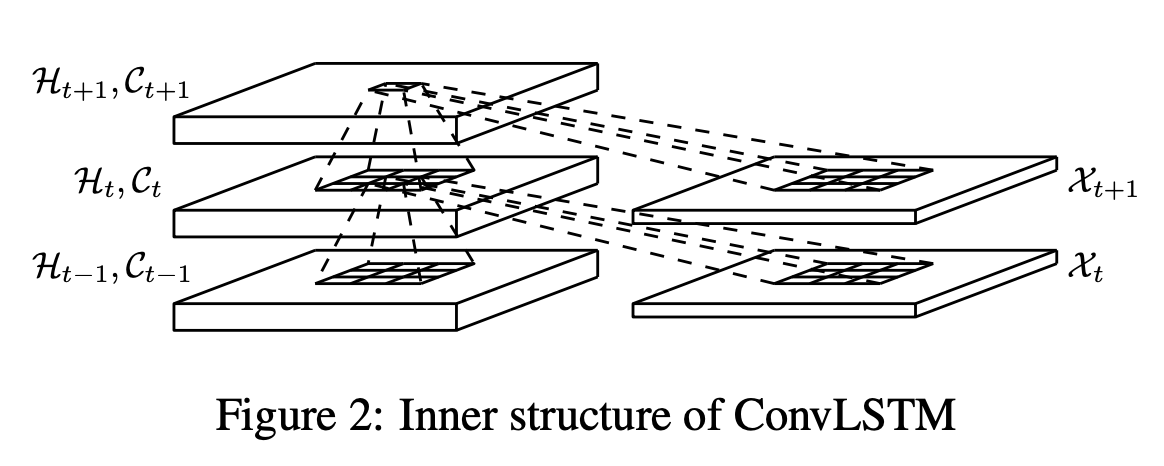

ConvLSTM is another unique approach to modelling the data generating process where it combines a convolution layer with an LSTM cell. This allows the model to learn to look at both shorter time horizons and longer time horizons at the same time as can be seen in the figure (one box in the top layer is equal to 9 boxes in the bottom layer giving it a much wider field of view). This should, in theory, allow the model to exploit the best of both worlds when being evaluated on sequences of different lengths. This is also verified by the model performing similarly on all three horizons of data it was fed. This model was trained with 64 filters, 20 units and a learning rate of 10-3.

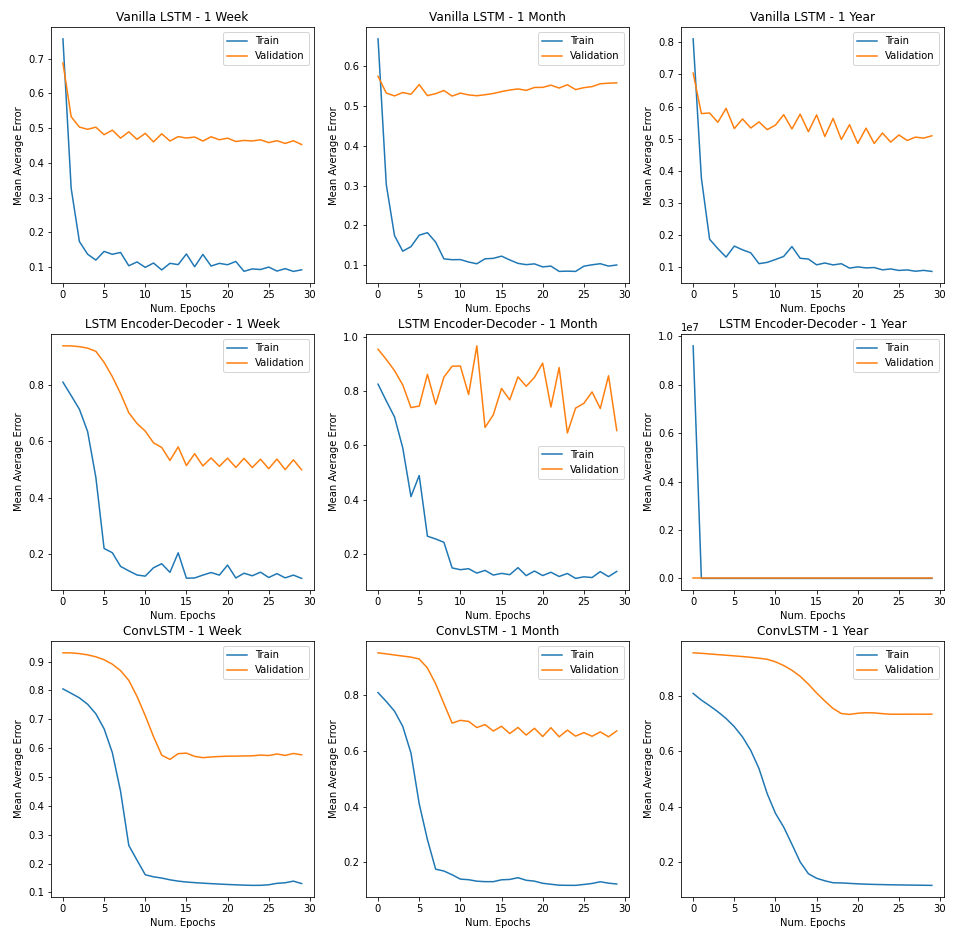

- Our models generally performed better at shorter time horizons i.e. all models recorded a lower validation error when the input sequence had fewer timesteps (1 week vs 1 year). This might suggest a failure in capturing seasonality.

- Every single model strongly overfitted to the input data suggesting a failure in learning the underlying data generating process. This might suggest that our LSTM models are way too powerful and have just gotten really good at remembering data.

- Note: The subpar performance on the validation set might not be a terrible thing if you believe in the efficient market hypothesis. Since the SPY values are standardized, Being 0.4 units away on average isn’t necessarily bad given the standard deviation is 1 unit. However, this model might not be very effective for day trading.

- Simpler models generally performed better than more complex models as can be seen by the performance of vanilla LSTM with others.

- We believe there is room for improvement and hyperparameter tuning with the encoder-decoder model as it struggled to learn an internal representation that is powerful enough to effectively separate the output signal. This is reflected in a very ragged loss curve which is highly sensitive to small movements in the hyperplane. A lower learning rate and batch size might help with faster convergence, but the model needs a different architecture to learn a better internal representation.

- ConvLSTM’s had the fastest convergence of the three models given the ease of parallelizing convolutional operations on the GPU.

The most important features of our best performing model are shown in the acompanying tables in terms of their absolute weight values.

Key takeways:

- Inflation and producer price indices are important at all time horizons

- In the short run (1 week), markets seem to be dictated by inflation. This can be seen by the presence of features like: 10-year inflation rate and multiple producer price indices ranging from information to industry.

- In the medium run (1 month), industrial production and cost seems to play a key role.

- In the long run (1 year), foreign exchange and different consumer credit rates seem to play a key role. These include things like mortgage and primary credit rates.

We break down our model proposal as follows:

Model suggestion: We propose a neural-network based approach for multivariate forecasting on the grounds that the data are complex, and LSTM networks perform empirically well on sequential data.

To test our models’ abilities with forecasting, we were supplied three different dates in the testing dataset, each predicted signal of which must include the following ranges: one week, one month, and one year.

- LSTM Vanilla LSTM (One week, one month, one year)

- Reasoning behind our model: This model allows a strong resemblance to an autoencoder and similar to an autoencoder it attempts to learn good internal representations of the data generating process.

- ConvLSTM LSTM (One month)

- Reasoning behind our model: This method combines a convolution layer with an LSTM cell, and allows the model to learn to look at both shorter time horizons and longer time horizons simultaneously.

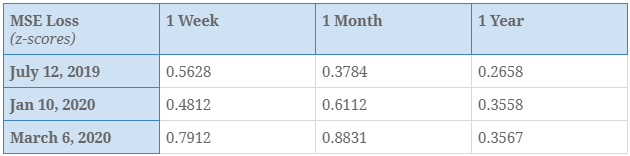

The displayed results were derived by evaluating our best model on standardized S&P500 values over 100 epochs with early stopping, learning rate set to 10-4 and batch size=72. There is some room for improvement by tuning the hyperparameters. The standard deviation of S&P500 values is 1 so you can judge the square root of these values with respect to 1.

There are a few takeaways here:

- Our model seems to perform a bit better over longer time horizons.

- The 1 year performance is the model’s strongpoint.

- All these three test points were in massive bull markets so we should probably test it out more in bear markets.

- The model struggled to predict the dip in the market during COVID as it did not value Infectious Diseases as an important feature.

- This might be because the last time there was a spike in Infectious Diseases rate, in 2011 during the swine flu, we did not see any major impacts on the market.

- Also the markets seem immune to bad flu seasons during the time period that this model was trained on (2011-2015).

- The model has not seen what a recession looks like given it was trained from 2011 onwards so it struggled to perform well when the COVID-crash occurred.

Conclusion

Our goal for this study is to find and optimize sequential forecasting models to generate predictions across three different time frames: one week, one month, and one year. We started by cleaning the data, standardizing and categorizing the data in a total of 67 features into three categories, External Macro Relationships, Internal Interactive Effects, and Low-Frequency Fundamental Data. To impute the missing values in our dataset, we calculated the R-squared values on our validation set combining the techniques of Interpolate using length of interval (time), Forward/Backward Fill, Rolling Statistics (Mean/Median) to produce a best-fit linear correlation with the target variable. In addition, we obtained a more precise dataset from the added features by adopting the polynomial fitting method to remove seasonality from the features, and a combination of linear regression and differencing to remove trend.

Followed by that, we tested the dataset on Vanilla LSTM Architecture, LSTM Encoder- Decoder Architecture, and ConvLSTM Architecture to generate the best fit deep learning model for forecasting the dataset. We have found that all three models performed higher than expected. We observed the RNN-based modeling performed the best optimization for the training sets as it has a strong memorizing behavior to the fed in sequential data. However, these models were not able to generalize well to other data points. We also prove that a high model complexity does not necessarily yield better predictions, perhaps optimizing some hyperparameters, such as the batch size, learning rate, number of LSTM cells, and adding dropout.